In the United States, overtime pay represents a crucial aspect of employment law, safeguarding workers’ rights to fair compensation for hours worked beyond the standard workweek. While federal guidelines set the groundwork for overtime compensation, individual states often have their own rules that can provide additional protections to workers.

These state-specific regulations can vary significantly, affecting how overtime is calculated, who is eligible, and under what conditions. In instances where state and federal overtime legislation varies, employers are typically required to comply with the law that provides the greatest benefit to the employee.

For employers, knowledge of these laws is critical to ensure compliance and avoid legal complications. For employees, being informed about both federal and state overtime laws is key to safeguarding their rights to fair pay.

Disclaimer: Please note that the information provided in this blog post is accurate as of the time of writing. Laws and regulations are subject to change over time. While we strive to keep our content as up-to-date as possible, we encourage readers to consult official government resources or legal professionals for the most current information. This blog is intended for informational purposes only and should not be taken as legal advice.

Federal Overtime Pay Law – Fair Labor Standards Act (FLSA)

The Fair Labor Standards Act (FLSA) is the cornerstone of federal overtime pay regulations, ensuring employees receive proper compensation for hours worked beyond the standard workweek. Here’s a brief overview of the key components related to overtime under the FLSA:

Definition of Overtime Pay

Overtime pay is required for hours worked over 40 in a workweek, at a rate not less than one and a half times the employee’s regular rate of pay. This provision applies to most employees, with specific exemptions outlined by the Act.

Eligibility Criteria for Overtime Pay

The FLSA covers employees who work for companies that do business across state lines or make products for interstate commerce, including those whose jobs are directly connected to or play a key role in these activities. This includes, but is not limited to, employees in communications, transportation, and public agencies.

Calculation of Overtime Pay

The calculation of overtime pay is based on the employee’s regular rate of pay, which includes all remuneration for employment except for certain exclusions specified by the FLSA. Overtime must be calculated on a workweek basis, without averaging hours over two or more weeks.

Here’s how it works:

- Regular Rate Calculation – To calculate the regular rate, divide the employee’s total compensation in a workweek (including salary, hourly wages, and nondiscretionary bonuses) by the total hours worked in that week. The regular rate may vary if the employee receives different types of compensation.

- Time-and-a-Half Pay – Once the regular rate is determined, any hours worked beyond 40 in a workweek must be compensated at one and a half times the regular rate. For example, if the regular rate is $15 per hour, the overtime rate would be $22.50 per hour.

Exemptions and Exceptions

Not all employees are eligible for overtime pay under the FLSA. Exemptions include workers in some administrative, professional, and executive roles, and specific industries or roles may have unique rules. Moreover, the FLSA does not mandate overtime pay for work on weekends, holidays, or regular days of rest, unless it involves work exceeding the standard 40-hour workweek.

This foundational understanding of the FLSA’s overtime provisions sets the stage for exploring how state-specific laws may offer additional protections for workers beyond these federal guidelines.

Overtime Pay Laws by State

The following section provides insights into States that have enacted their own overtime pay legislation versus those adhering to federal standards.

Included is a breakdown of the specific daily or weekly work limits and the applicable overtime rates for each state. Any hours worked beyond these daily or weekly limits are considered overtime.

Alabama

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Alaska

State overtime law: Yes – Learn more

Daily limit: 8 hours

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Arizona

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Arkansas

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

California

State overtime law: Yes – Learn more

Daily limit: 8 hours (1.5x) / 12 hours (2x)

Weekly limit: 40 hours / 6-day workweek

Overtime rate:

- 1.5 x regular rate of pay for all hours worked above 8 hours up to and including 12 hours in any workday, and for the first eight hours worked on the seventh consecutive day of work in a workweek

- 2 x regular rate of pay for all hours worked above 12 hours in any workday and for all hours worked above 8 on the seventh consecutive day of work in a workweek

Colorado

State overtime law: Yes – Learn more

Daily limit: 12 hours

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Connecticut

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Delaware

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

District of Columbia

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Florida

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Georgia

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Hawaii

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Idaho

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Illinois

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Indiana

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Iowa

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Kansas

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 46 hours

Overtime rate: 1.5 x regular hourly rate

Kentucky

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours / 6-day workweek

Overtime rate: 1.5 x regular hourly rate

Louisiana

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Maine

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Maryland

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours (48 hours and 60 hours for specific groups of workers)

Overtime rate: 1.5 x regular hourly rate

Massachusetts

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Michigan

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Minnesota

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 48 hours

Overtime rate: 1.5 x regular hourly rate

Mississippi

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Missouri

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Montana

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Nebraska

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Nevada

State overtime law: Yes – Learn more

Daily limit: 8 hours

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

New Hampshire

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

New Jersey

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

New Mexico

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

New York

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

North Carolina

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

North Dakota

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Ohio

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Oklahoma

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Oregon

State overtime law: Yes – Learn more

Daily limit:

- No limit for most workers. Workers in canneries, driers and packing plants NOT located on farms and primarily processing products produced on that farm are required to be paid for any hours worked over 10 in a day

Weekly limit: 40 hours (55 hours for agricultural workers)

Overtime rate: 1.5 x regular hourly rate

Pennsylvania

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Rhode Island

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

South Carolina

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

South Dakota

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Utah

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Vermont

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Virginia

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Washington

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

West Virginia

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Wisconsin

State overtime law: Yes – Learn more

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Wyoming

State overtime law: No

Daily limit: No limit

Weekly limit: 40 hours

Overtime rate: 1.5 x regular hourly rate

Overtime Pay Laws Compliance Tips

Following overtime pay laws requires meticulous management practices and the strategic use of Time and Attendance technology. Below are essential tips for employers who are currently navigating these regulatory landmines.

1. Maintain Accurate Timekeeping Records

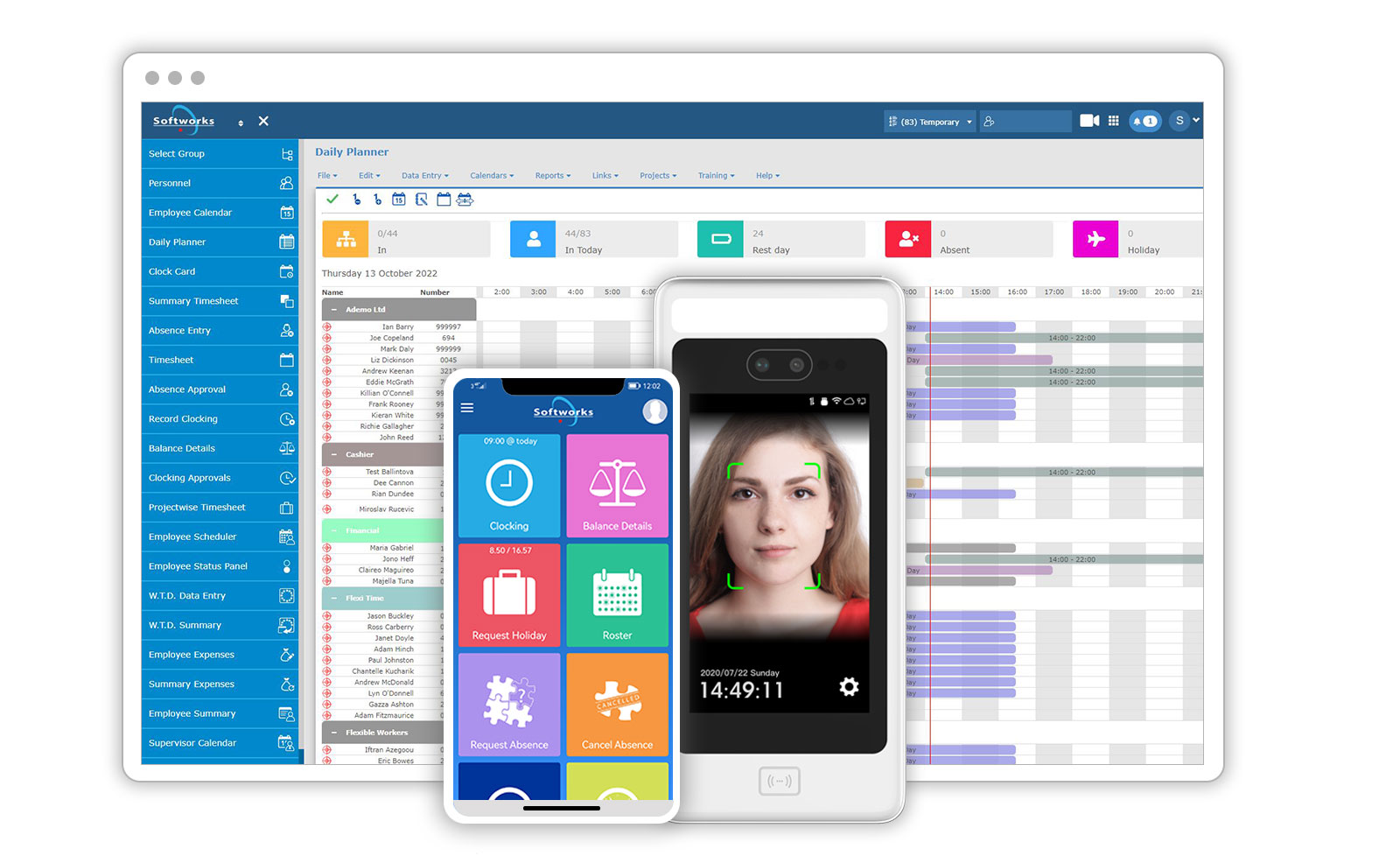

Keeping detailed records of hours worked, both regular and overtime, is essential. Utilizing workforce management software equipped with Time & Attendance functions can automate this process.

2. Fair Scheduling Practices to Increase Employee Engagement

Formulate scheduling policies that ensure a fair distribution of work hours, aiming to reduce the necessity for excessive overtime. Workforce management tools that include Employee Scheduling capabilities via personal devices can aid in refining the scheduling process by taking into account various factors like employee preferences, skill levels, and compliance with labor regulations, thus crafting schedules that are both efficient and lawful.

3. Establish Transparent Overtime Policies

It’s crucial to clearly define and communicate your organization’s overtime policies to all employees. This includes clarifying the calculation of overtime, its applicability, and the compensation method. Workforce management software can be instrumental in sending automatic alerts to employees nearing or exceeding set overtime limits, enhancing transparency, and aiding compliance.

4. Utilize Time and Attendance Management Software

Integrating comprehensive time and attendance management software can significantly streamline the process of tracking time, calculating overtime, and processing payroll accurately. Such software not only automates the tracking and reporting of hours worked but also helps in identifying overtime trends, enabling employers to make informed decisions and ensure compliance with overtime pay laws effectively.

By implementing these strategies and harnessing the capabilities of workforce management software, employers can better navigate the complexities of overtime regulations, ensuring both compliance and fair compensation for their employees.

Conclusion

The intricate web of overtime pay laws across the United States, encompassing both federal and state levels, underscores the critical importance of staying informed and compliant. For businesses, navigating these regulations is essential not only to avoid legal complications but also to uphold fair labor practices, ensuring employees are compensated justly for their time and effort.

Maintaining compliance demands a rigorous approach to record-keeping, equitable scheduling, clear communication of overtime policies, and precise payroll processing. These are non-negotiable aspects of workforce management that, when handled efficiently, contribute to the smooth operation of businesses and the well-being of employees.

For organizations looking to streamline these processes and ensure compliance with overtime pay laws, leveraging the capabilities of advanced time and attendance software is a game-changer.

In this context, Softworks Time and Attendance Management Software stands out as a robust tool that can significantly ease the complexities of managing overtime. It offers a seamless way to automate time tracking, accurately calculate overtime, optimize schedules according to business needs and legal requirements, and ensure transparent communication regarding overtime policies.

Try Softworks Time and Attendance Management Software by booking a demo, and experience firsthand how it can transform your approach to managing overtime, fostering a compliant, efficient, and fair workplace.

Request a free Demo!

Take the first step towards a complete workforce management solution. Talk to us today!

Sources

- Overtime Pay, U.S. DEPARTMENT OF LABOR, Wage and Hour Division (.gov)

- Handy Reference Guide to the Fair Labor Standards Act, U.S. DEPARTMENT OF LABOR, Wage and Hour Division (.gov)

- Fact Sheet #23: Overtime Pay Requirements of the FLSA, U.S. DEPARTMENT OF LABOR, Wage and Hour Division (.gov)

- Minimum Wage Standard And Overtime Hours, Alaska Department of Labor and Workforce Development, Labor Standards and Safety Division (.gov)

- FAQs, Arkansas Department of Labor and Licensing (.gov)

- FAQ Overtime, State of California, Department of Industrial Relations (.gov)

- Colorado Overtime And Minimum Pay Standards Order (Comps Order) #39, Colorado Department Of Labor And Employment, Division Of Labor Standards And Statistics (.gov)

- Wage And Hour – Minimum Wage And Overtime, State of Connecticut, CT Department of Labor (.gov)

- Minimum Wage and Overtime, State of Hawaii, Wage Standards Division (.gov)

- Worker Rights, Illinois Department of Labor (.gov)

- Hours of Work and Overtime, Indiana State Personnel Department (.gov)

- Workplace Laws FAQs, Kansas Department of Labor (.gov)

- Title 803 | Chapter 001 | Regulation 061, Kentucky General Assembly (.gov)

- Title 26: Labor And Industry, Chapter 7: Employment Practices, Subchapter 3: Minimum Wages, Maine Legislature (.gov)

- Wage Laws, The People’s Law Library of Maryland

- Minimum wage and overtime information, State of Massachusetts (.gov)

- The Improved Workforce Opportunity Wage Act, Michigan Bureau of Employment Relations – Wage and Hour Division (.gov)

- A guide to Minnesota’s overtime laws, Minnesota Department of Labor and Industry (.gov)

- Work Hours, Travel, and Overtime Pay, Missouri Department of Labor and Industrial Relations (.gov)

- Wage and Hour Labor Law Reference Guide, Montana Department of Labor & Industry (.gov)

- FAQs, State of Nevada Department of Business & Industry Office of the Labor Commissioner (.gov)

- Wage and hour compliance: laws and regulations, New Jersey Department of Labor and Workforce Development (.gov)

- Labor Relations FAQs, New Mexico Department of Workforce Solutions (.gov)

- Overtime Frequently Asked Questions, New York State Department of Labor (.gov)

- Overtime Pay, Salary and Comp Time, North Carolina Department of Labor (.gov)

- Chapter 46-02-07 North Dakota Minimum Wage And Work Conditions Order, North Dakota Legislative Branch (.gov)

- Section 4111.03, Overtime, Ohio Revised Code, Ohio Laws (.gov)

- Overtime, For Employers, Oregon Bureau of Labor & Industries (.gov)

- General Wage and Hour Questions, Pennsylvania Department of Labor & Industry (.gov)

- Labor Standards FAQ, Rhode Island Department of Labor and Training (.gov)

- A Summary Of Vermont Wage And Hour Laws, Vermont Department of Labor (.gov)

- Virginia Overtime Wage Act, Virginia Department of Human Resource Management (.gov)

- Overtime & Exemptions, Washington State Department of Labor & Industries (.gov)

- State Overtime Requirements, West Virginia Division of Labor (.gov)

- Hours of Work and Overtime, Wisconsin Department of Workforce Development (.gov)

About Tomislav Rucevic

Tomislav Rucevic, an SEO Specialist at Softworks, stands out as more than just a marketer. He’s a fervent writer and influential thinker passionate about Workforce Management, HR, and work-life dynamics. Holding an MBA in Marketing, Tomislav excels in creating content that delves into the complexities of the modern workplace.

His dedication to writing on these topics is highlighted in his MBA thesis, which examined the link between Employee Motivation and Quality Improvement. At Softworks, he expertly merges his SEO skills with his writing prowess, contributing to the company’s digital success and advancing discussions on enhancing work environments and achieving work-life balance.